Many in the Canadian Financial and Fintech sectors have been patiently (or impatiently) waiting for direction on Open Banking. This year, the Federal Government delivered in their 2023 Fall Economic Statement on Open Banking Implementation. For many, this is welcome news!

A few highlights:

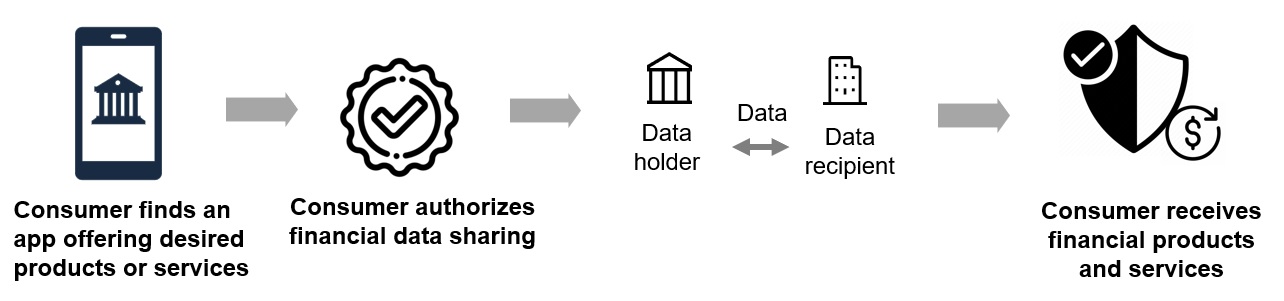

- We’ve now adopted the term Consumer-driven banking. Canada is applying this term to a “framework that allows consumers and small businesses to securely transfer their financial data through an API to approved service providers …”.

- Core framework elements are to include Governance, Scope, Accreditation, Common Rules, and Technical Standards.

- The framework legislation is to be introduced in Budget 2024, and will include a “phased in approach” and timeline.

How Consumer-Driven Banking Works (Canada Dept of Finance)

Congratulations to those in the sector(s) who have been fighting hard to get something concrete laid out. Onward!